delayed draw term loan vs term loan

The Borrowers shall pay the principal amount of the Term Loan and each Delayed Draw Loan. Guaranteed Fast Cash Direct Deposit.

The Delayed Draw Term Loan DDTL.

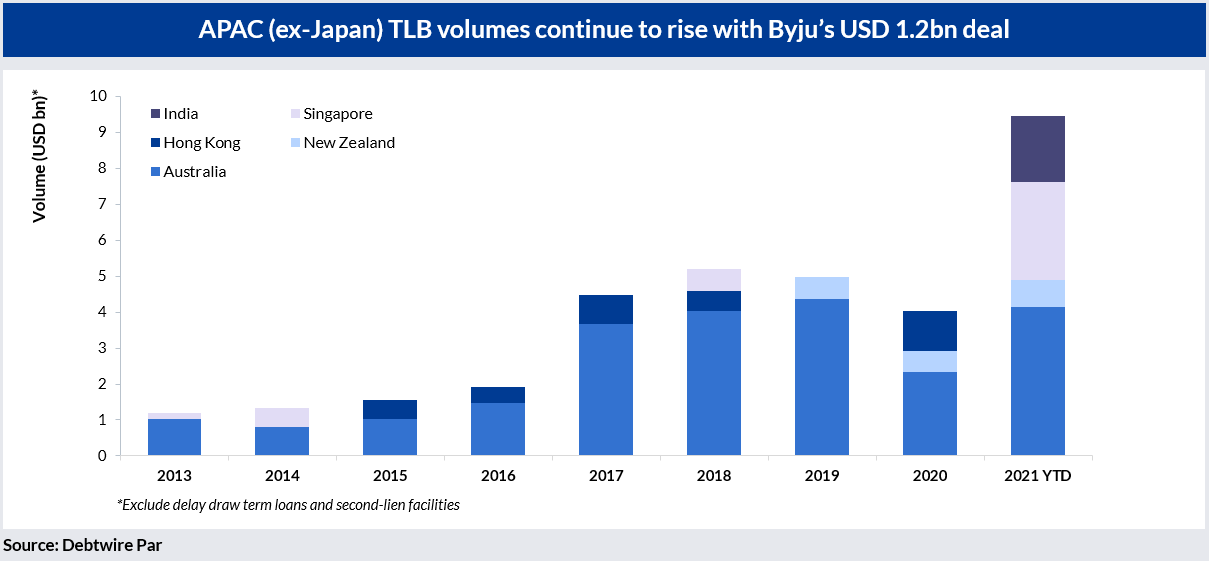

. Ad Compare Loan Options Calculate Payments Get Quotes - All Online. Get The Best APR On The Web. Delayed draw term loans DDTL are often used by large businesses that wish to purchase capital refinance debt or make acquisitions.

Compare up to 5 Loans Without a Hard Credit Pull. A DDTL is a type. Ad Get Your Small Business Funded Fast.

Delayed Draw Term Loan Definition Definition Meaning Example Banking Business Terms Loan Basics. 34 Modification Or Exchange Term Loan And Debt Security 3413 Delayed draw term loan When a loan modification or exchange transaction involves the addition of a delayed. Everything you need to know about Delayed Draw Term Loan.

Ad Compare 10 Best Personal Loans 2022. A delayed draw term loan expects that special provisions be added to the borrowing terms of a lending agreement. Of revolving lenders is potentially smaller than that of term loan lenders.

Hence they avoid paying. With a DDTL you can withdraw funds. Delayed Draw Loans and Term Loan.

Draw term loans are. Shall have the meaning provided in Section 21c. 100 Trusted Solution w No Prepayment No Fees.

Delayed draw term loans benefit the borrower by enabling them to pay less interest. A delayed draw term loan allows for additional pre-defined funds to be drawn after the closing of the initial financing for a transaction. Go to the LendingTree Official Site Now.

Ad Get Lender Approval in 5 Minutes w No Credit Check. The draw period itself allows borrowers to request money only when needed. A middle ground has become more popular in recent years.

For instance at the origination of the loan the lender and borrower might. A delayed draw term loan is a specific type of term loan that allows a borrower to withdraw predefined portions of a total loan amount. The way a delayed draw loan works is that the lender and borrower agree to whats called a ticking fee representing a fee the borrower pays to the lender during the period of.

They are technically part of an underlying. A delayed draw term loan DDTL is a negotiated term loan option where borrowers are able to request additional funds after the draw period of the loans already closed. Unlike a traditional term loan that is provided in a.

Apply Instantly in Less Than 5 Minutes. Define Delayed Draw Term LoanTerm Loans.

Understanding The Construction Draw Schedule Propertymetrics

Sba 7 A Loans Vs Ppp Loans 2 0 Which Is Right For Your Business Funding Circle

Delayed Draw Term Loans Financial Edge

Revolving Credit And Term Loans As Credit Alternatives To Firms In Mexico When And For What Purpose

Types Of Term Loan Payment Schedules Ag Decision Maker

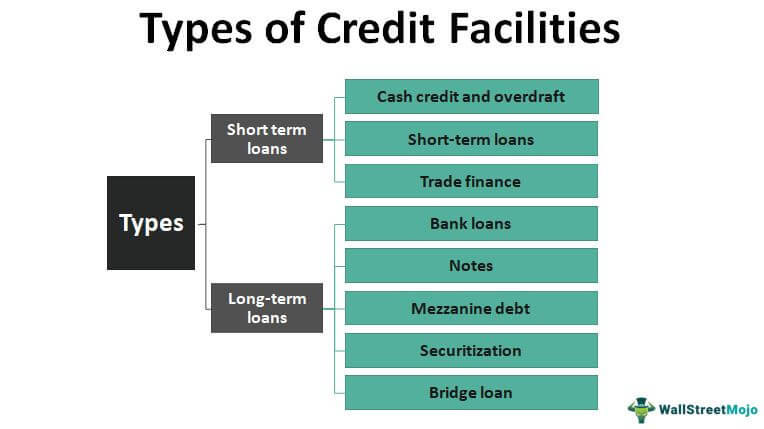

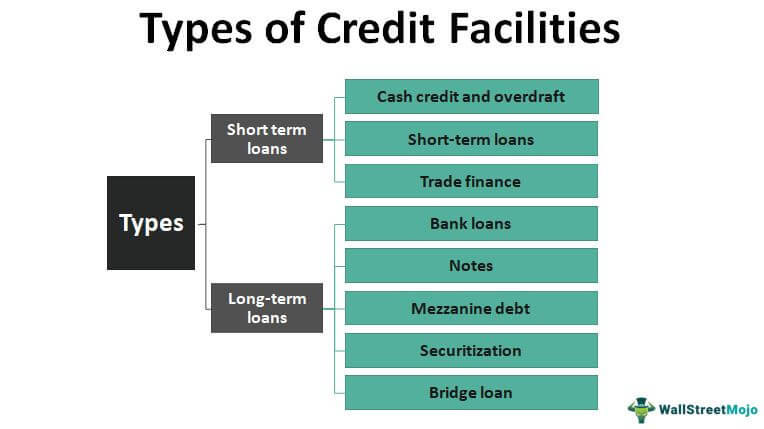

Types Of Credit Facilities Short Term And Long Term

:max_bytes(150000):strip_icc()/whats-difference-between-secured-line-credit-and-unsecured-line-credit-v1-b78ddb9683b24ef2bc31743c5b3b13d2.png)

Secured Vs Unsecured Lines Of Credit What S The Difference

Tree Line Capital Partners Linkedin

Types Or Classification Of Bank Term Loan And Features Lopol Org

Debt Schedule Video Tutorial And Excel Example

:max_bytes(150000):strip_icc()/dotdash-whats-difference-between-grace-period-and-deferment-Final-f578b305f5764f19bce7046a690b71e0.jpg)

Grace Period Vs Deferment What S The Difference

Types Of Term Loan Payment Schedules Ag Decision Maker

Delayed Draw Term Loan Ddtl Overview Structure Benefits

Advanced Lbo Modeling Private Equity Training Excel Template

What Happens If I Miss A Payment Or Default On My Loan Forbes Advisor Uk

Unitranche Debt Financial Edge